what is suta taxable

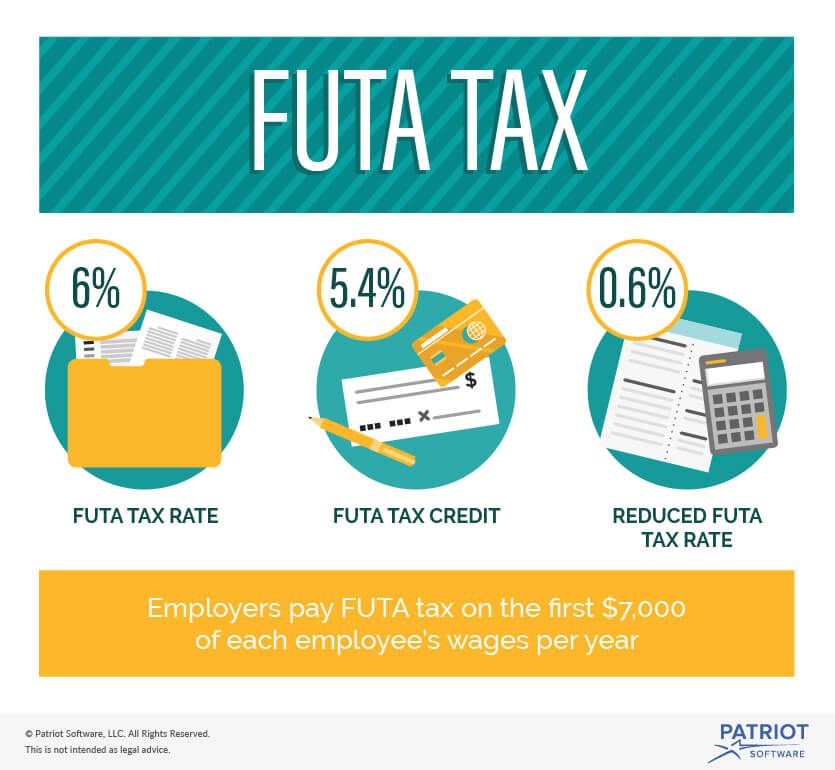

SUTA or the State Unemployment Tax Act is a tax that employers pay on employee wages. The FUTA tax rate is a flat 6 but is reduced to just.

Are Employers Responsible For Paying Unemployment Taxes

What are SUTA taxes.

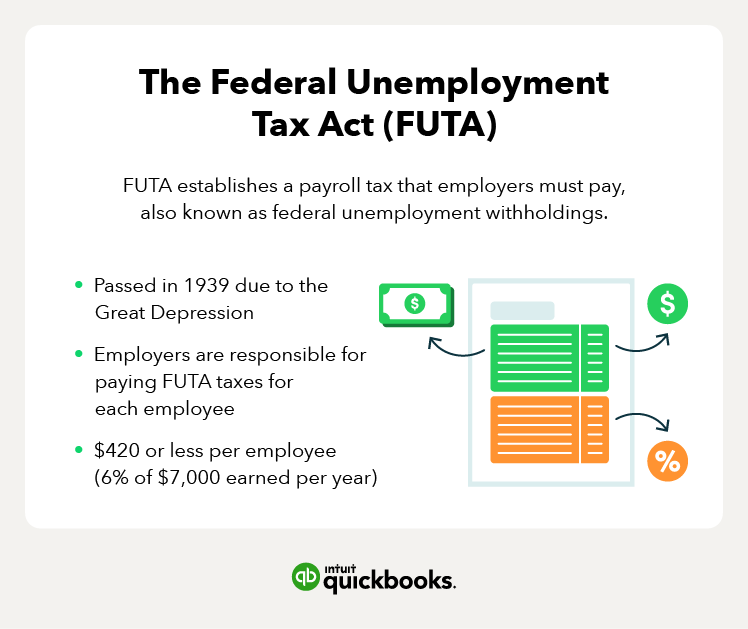

. The worst positive-rate class was assigned a tax rate of 691 percent resulting in a tax of 32131 when multiplied by the 46500 wage base. If you have any comments or questions about iFile please contact the Virginia Employment Commission at iFilevecvecvirginiagov. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

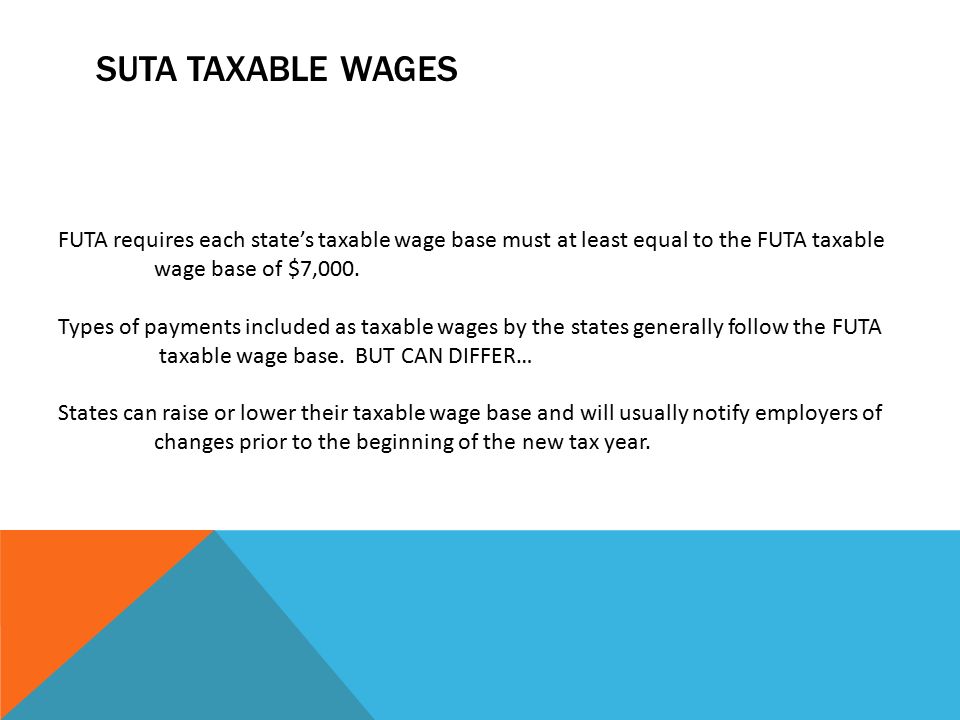

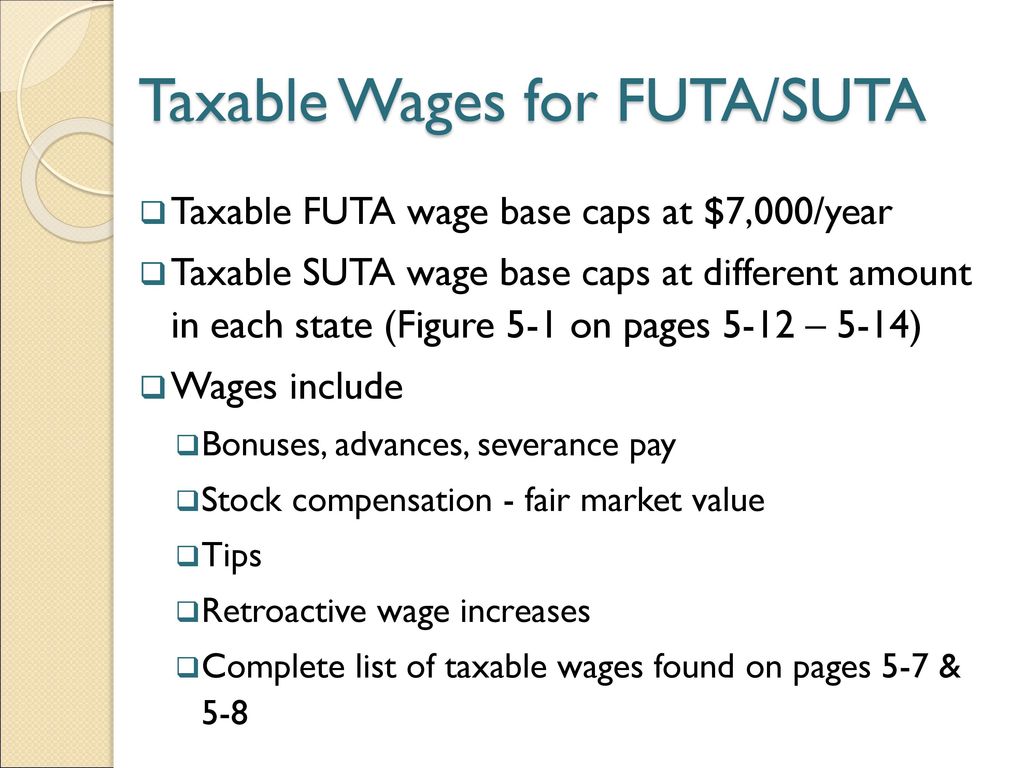

The State Unemployment Tax Act commonly referred to as SUTA tax is a state unemployment insurance program requiring employers to pay towards a fund. Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account information. The states SUTA wage base is 7000 per.

Heres how an employer in Texas would calculate SUTA. In some cases however the employee may also have to. Provided the state does not have any outstanding Title XII.

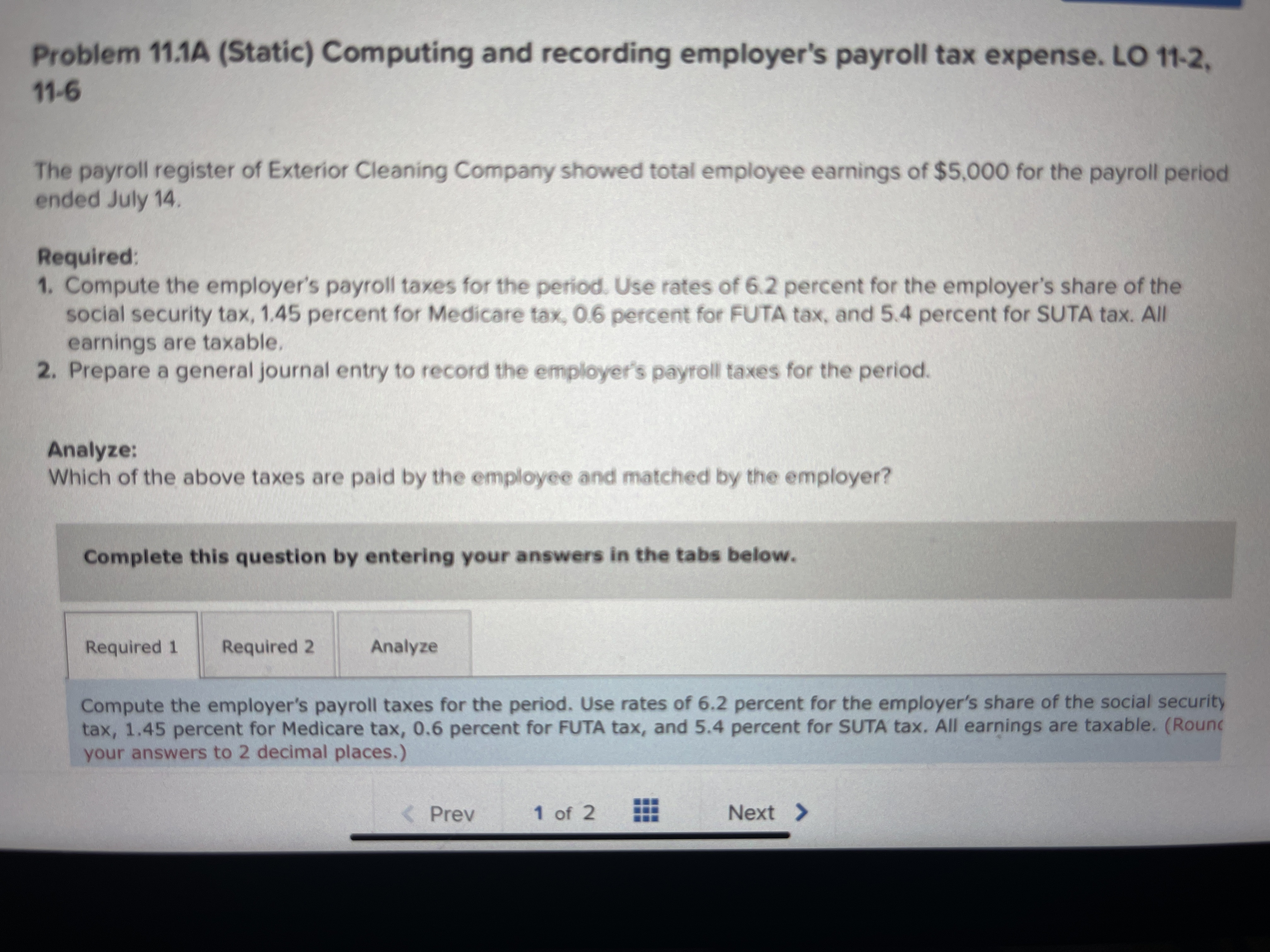

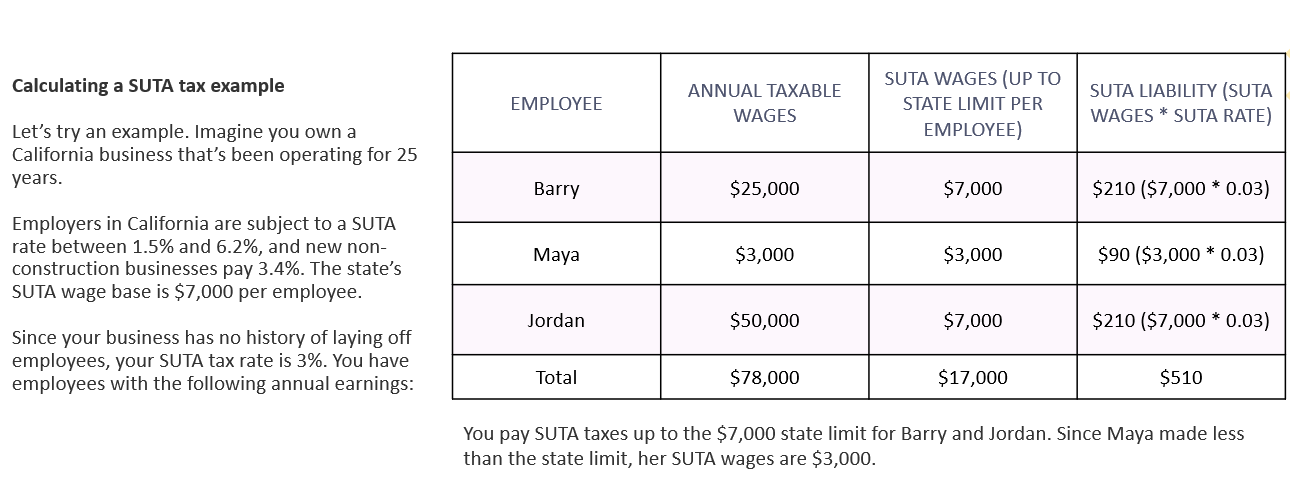

The original legislation that allows the federal government to tax businesses with employees for the purpose of collecting revenue. 9000 taxable wage base x 27 tax rate x number of employees Texas SUTA cost for the year. State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays.

It is a payroll tax that goes towards the state unemployment fund. The amount of the tax is based on the employees wages and the states unemployment rate. The yearly cost is divided.

Some states apply various formulas to determine the. State Unemployment Tax Act is also known as SUTA state unemployment insurance and SUI. Federal Unemployment Tax Act - FUTA.

The best negative-rate class was assigned a rate. The FUTA and SUTA taxes are filed on Form 940 each year regardless if a business has an employee on unemployment insurance. The responsibility of SUTA compliance falls to those in charge of company payroll and payments are most commonly made in quarterly installments.

Benefit Rights - The following information is a summary of the legal requirements and your rights and responsibilities while filing a claim for unemployment insurance benefits. You can get tax rate information and a detailed listing of the individuals making up the three-year total of benefit chargebacks used in your Benefit Ratio online or by phone fax. Link sends e-mail or 804 786-1082 or the Virginia.

File Wage Reports Pay Your Unemployment Taxes Online. The State Unemployment Tax Act SUTA tax is typically a payroll tax paid on employee wages by all employers. On an annual basis the department and IRS conduct a cross match to ensure that employers are paying both taxes.

Read all of this.

Unemployment Insurance Taxes Iowa Workforce Development

Federal Unemployment Tax Who Pays Futa Exempt Wages Exempt Employment Futa Tax Rate Wage Base Depositing Reporting Futa Tax Calculating Ppt Download

Answered Problem 11 1a Static Computing And Bartleby

What Is Sui State Unemployment Insurance Tax Ask Gusto

Suta Tax Requirements For Employers State By State Guide

Suta Tax Your Questions Answered Bench Accounting

What Is Suta Tax Definition Rates Example More

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

Chapter 5 Payroll Accounting 2011 Unemployment Compensation Taxes Ppt Download

What Is Suta Tax State Unemployment Taxes Explained

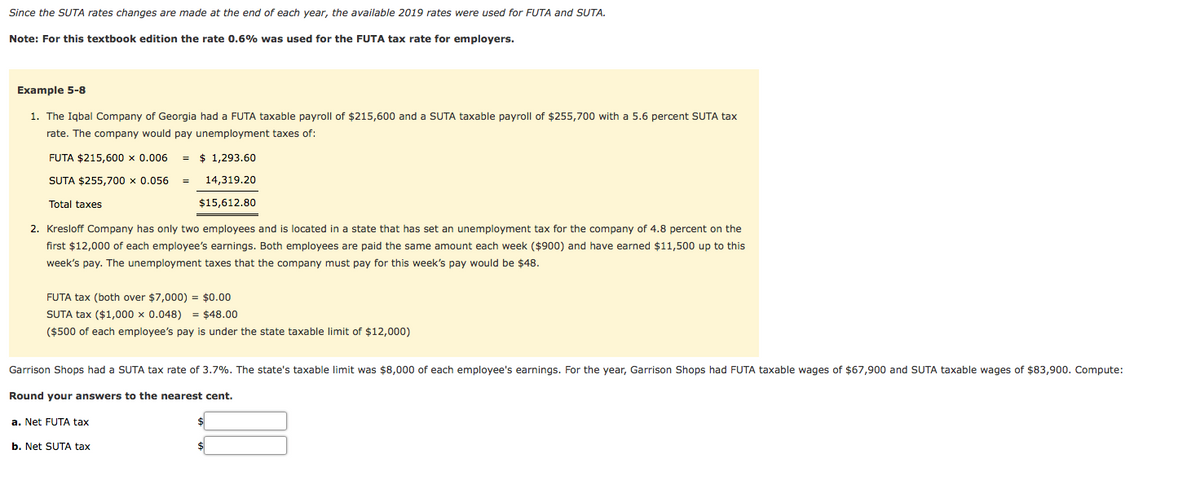

Answered Garrison Shops Had A Suta Tax Rate Of Bartleby

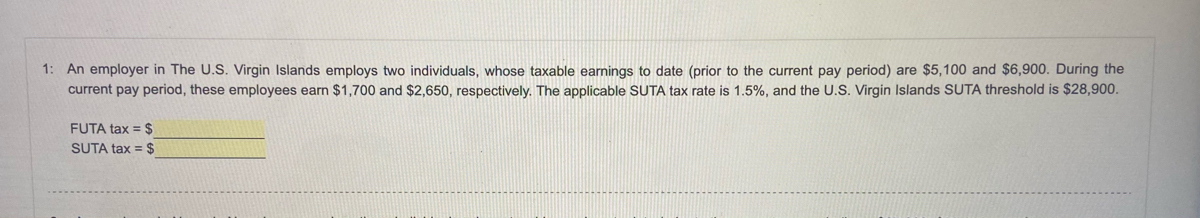

Answered 1 An Employer In The U S Virgin Bartleby

Dor Unemployment Compensation State Taxes

Employers General Ui Contributions Information And Definitions Division Of Unemployment Insurance