georgia film tax credit history

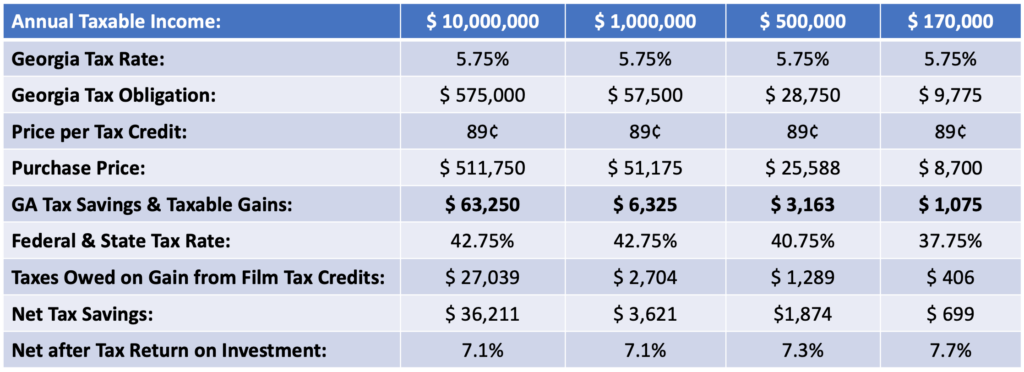

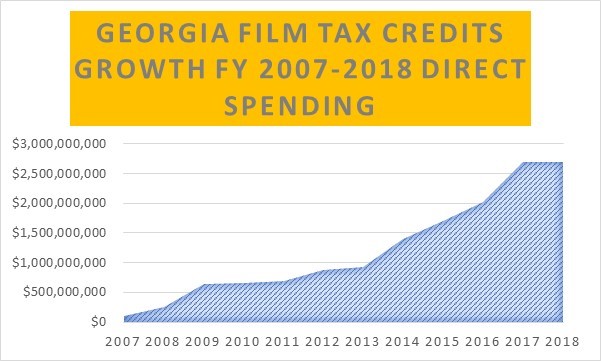

For example you could purchase 20000 of 2017 Georgia Entertainment Credits for 17400 resulting in an immediate savings of. The tax credit had grown from 141 million in 2010 to an estimated 870 million in 2019.

Opinion Ga S Film Tax Credits Are Big Budget Flop

GA Film Tax Credit - List of Expenditures final 12-14-18pdf 3015 KB.

. GEORGIA FILM TAX CREDIT FUND LLC was registered on Feb 23 2012 as a domestic limited liability company type with the address. Atlanta is the center of the film industry. To calculate your tax credit simply multiply your qualified Georgia expenditures by 20.

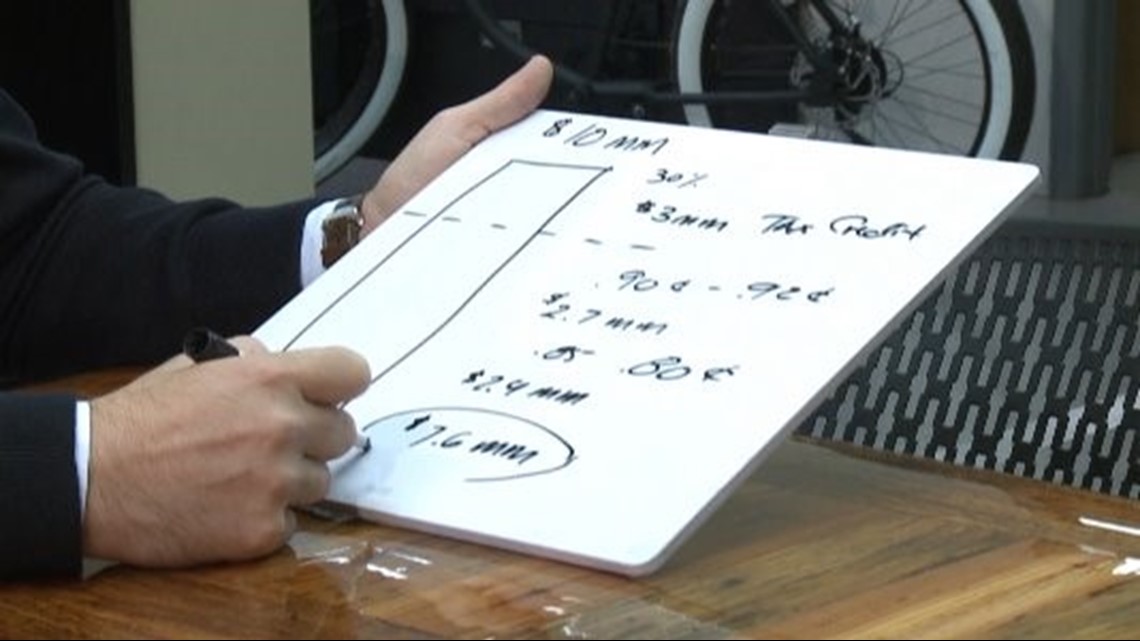

To earn the 20 film tax credit the Georgia Department of Economic Development must certify the project more on this later. An additional 10 credit is given for placing a Georgia logo in your film title or. On average 1 of Georgia Film Tax credit can be purchased for 087 to 090.

However companies received film tax credits they did not qualify auditors claim. Some Georgia film tax incentives include. Productions that qualify receive a 20 tax credit.

For example for a base investment in Georgia of 20000000 your savings would be 4000000. Georgia film tax credit history Monday. This is an easy way to reduce your Georgia tax liability.

In fact according to the Georgia Department of Economic Development there was a new record set last year with 399 productions filmed representing a 29B infusion to the. An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25 million in 2021 125 million in 2022 and for any credit amount thereafter. Georgia doled out a record 12 billion in film and TV tax credits last year far surpassing the incentives offered by any other state.

The big finding is that Georgias film incentive returned only 10 cents per dollar of tax credit given. The film industry in Georgia is the largest among the states of the United States for production of feature films by number of films produced as of 2016. Georgias Entertainment Industry Investment Act provides a 20 tax credit for filming and entertainment industries that spend 500000 or more on production and post.

Production companies are required to withhold 6 Georgia income tax on all payments to loan. The figure is 40 higher than the states.

Georgia Senate Panel Proposes 900 Million Cap On Film Tax Credit Variety

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Why Most Filmmakers Sell Off Their Georgia Tax Credits 11alive Com

Analysis Georgia S Film And Tv Incentives Could Become Part Of A 2020 Budget Battle

Georgia Film And Tv Tax Credit Jumps To A Record 1 2 Billion Variety

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Decd Commissioner David Lehman Calls For Cutbacks To Ct Film Tax Credit

Movie Tv Tax Credit Cap Removed From Georgia Legislation

Georgia Touts Record 2 9 Billion In Direct Film Tv Spending In Fy2019

Ryan Reynolds Free Guy Got 20 1m From Mass Taxpayers Part Of Nearly 100m Of Film Tax Subsidies In 2019 The Most In A Decade The Boston Globe

Another Record Breaking Year For Georgia Film And Tv 455 Productions 2 7 Billion In Direct Spending

Film And Tv S Tax Credits A State Guide To Competition The Hollywood Reporter

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

How Oprah Walmart Scored Tax Breaks On Films That Others Made

Georgia Entertainment Tax Credit Services Company

Georgia Hb 1037 Instills Integrity For Hollywood Of The

Entertainment Accounting And Financial Services Mauldin Jenkins